main street small business tax credit 1

MainStreet is on a mission to help every small business make a big impact. Find information on Tax Credits LLC including this business SIC codes NAICS codes and General Liabilility Class codes.

Main Street Alliance Main Street Action Mainstreetweets Twitter

This bill provides financial relief to qualified small businesses for the economic.

. Your Main Street Small Business Tax Credit will be available on April 1 2021. Apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally. What is the maximum amount of credit allowed per each qualified small.

We take the guesswork out of tax credits and pass the untapped savings onto you. The Main Street Small Business Tax Credit is calculated based on monthly full-time employees. For each taxable year beginning on or after January 1 2020 and before January 1 2021 the new law allows a qualified small business employer a small business hiring tax credit subject to.

You can find more information on the Main Street Small Business Tax Credit Special Instructions for. The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. Tax Credits LLC In Piscataway NJ.

Taxpayers can use the credit against income taxes or can make an. Tax Credits LLC at 45 Knightsbridge Rd Piscataway NJ 08854. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

Tax Credits LLC is primarily. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive financial.

The Main Street Small Business Tax Credit is for employers affected by the economic disturbances of 2020. Join for free Build with confidence Your work is worth more than you think Billions of dollars in tax credits are set aside each year for companies that prioritize innovation through RD work. The Main Street Small Business Tax Credit is a relief fund for Californias small businesses to help them get back on their feet and heal the economy.

Taxpayers must make a credit reservation in order to claim the credit. A qualified small business tax credit employer is the one who files an original tax return to get the Main Street Small Business tax credit instead of an amended one. This bill provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that have resulted in unprecedented job losses.

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

Main Street Lending Program Provides Working Capital For Small Businesses

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Main Street Small Business Tax Credit Available For Cal Businesses

Virginia Tax Credits Opportunities To Save While Supporting America S Students Cassaday Company Inc

Main Street Small Business Tax Credit Available For Cal Businesses

Ca Offers Two Covid 19 Relief Programs San Leandro Next

The Big List Of U S Small Business Tax Credits Bench Accounting

Business Tax Accountant Advocate

What Is The Main Street Small Business Tax Credit Tax Hive

2021 Main Street Small Business Tax Credit In California Heather

A Guide To Small Business Taxes Ramsey

What Is The Small Business Health Care Tax Credit Ramsey

The Main Street Small Business Tax Credit For Small Businesses Launched Last Week Get Started And Learn More At Taxcredit Cdtfa Ca Gov By State Of California Franchise Tax Board Facebook

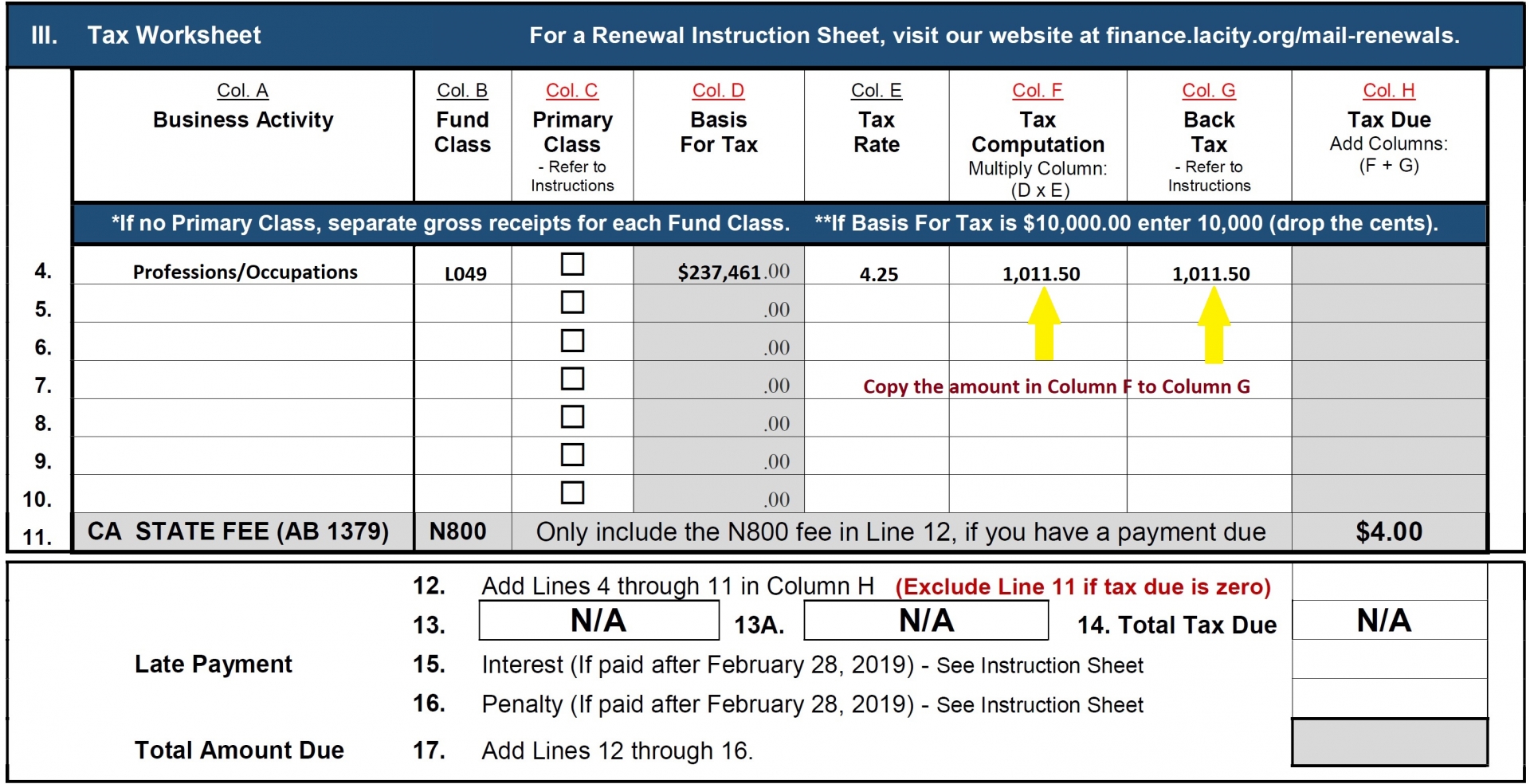

Business Tax Renewal Instructions Los Angeles Office Of Finance

How To Get Your Maximum Tax Refund Credit Com

Live Online Event Tax Credits 101 Part 2 New Markets And Historic Tax Credits Youtube

2021 Main Street Small Business Tax Credit In California Heather